Introduction/Overview

Trade360 is a Cyprus-based broker which offers a variety of asset classes to traders. These include foreign exchange currency pairs, commodities, indices and more. The broker’s minimum deposit level is $250 US dollars, and it has a variety of funding methods and more.

It is also worth noting at this stage that Trade360 is licensed by a range of regulators around the world. The main one it is regulated by is CySEC, which stands for Cyprus Securities and Exchange Commission and offers traders in Europe a variety of protections. The broker is also regulated by the Australian Securities and Investments Commission, or ASIC for short – although in its risk warning it claims that residents of Australia are not permitted to trade on the platform.

A distinctive reason why a trader might choose the Trade360, meanwhile, is that it has also won a number of awards during its time in existence. The European named it the Best Gold Trading Broker for 2020 at that year’s Global Banking and Finance Awards, for example, while it was also named Broker of the year 2017 and Broker of the Year 2020 at the Atoz Forex.com awards too.

Features

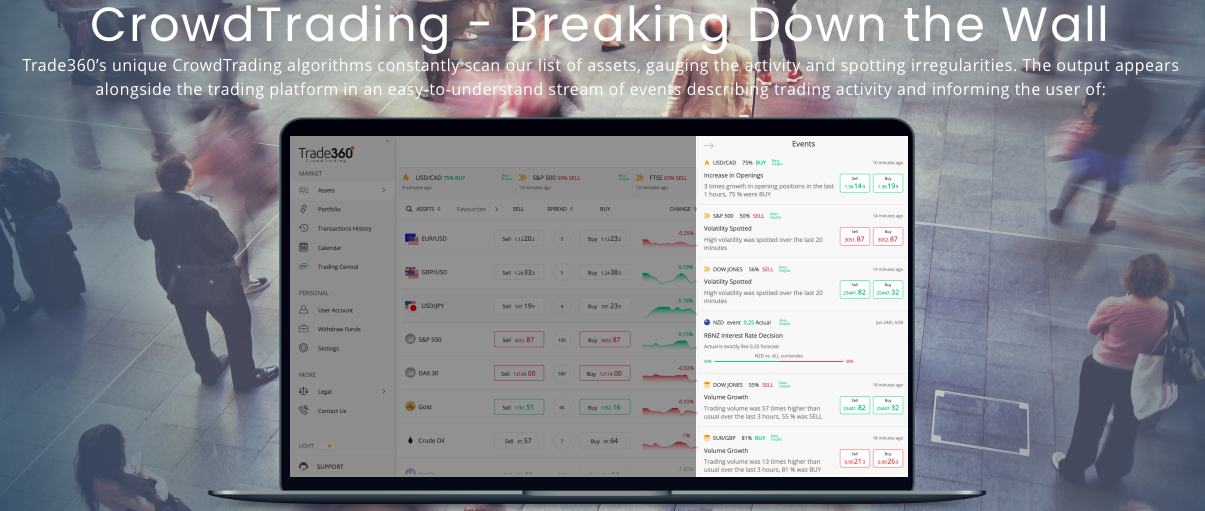

Traders who use Trade360 will soon note that the broker’s main unique selling point is “CrowdTrading” – a system of algorithms which is designed to improve the trading experience and allow the trader to learn more about what is going on in the markets. The system, known on the platform as “CrowdFeed”, can identify trends and send a notification to the trader in order to let them know.

But that’s not all it can do. It also has a “rapid activity” function, which works by monitoring how much has been bought and sold in terms of each individual asset. This can then be used to work out a potential rate of volatility, helping the user to get a better idea of market sentiment. The same tool can also spot a trend reversal.

Finally, this innovative feature at Trade360 can be used to monitor for what the platform describes as “surges”. These surges often happen in the run-up to an announcement about a key event, such as an economic calendar event. With an algorithm like this on side to help, traders can be alerted quickly to what’s taking place.

Account Types

One of the distinctive advantages of choosing a broker like Trade360 is that it has a complex yet choice-friendly account type structure that gives maximum flexibility to trading professionals. Each account type comes with a slightly different permutation of features, minimum deposit types and more.

All accounts at Trade360 come with a series of core features designed to make them work well. These include a live crowd trading feed as well as support with trading signals. And they also all offer live chat customer service support around the clock – at least on weekdays.

But from there things begin to get different. The basic account type on offer at Trade360 is the “Mini” account. This requires a minimum deposit of $250 US dollars, and does not offer access to the MetaTrader 5 platform – which is something all of the other account options do. Moving up a level, the “Standard360” account requires traders to put down a minimum deposit of $1,000 US dollars. As is the case with the “Mini” account, though, traders do not receive the additional services that more sophisticated accounts do – such as push and SMS notifications, and market updates.

From there, the minimum investment levels get higher. However, all of the accounts at this level and above come with every advertised service – offering the chance for value for money. The “Gold” account, for example, requires a minimum deposit of $5,000 US dollars. The “Platinum” account, meanwhile, requires a minimum deposit level of $10,000 US dollars. From there, the “Diamond” account asks traders to put down a minimum deposit of $50,000 US dollars. And, finally, the “VIP” account requires traders to place a deposit of $100,000 US dollars.

It is also worth noting that each account type comes with a different so-called “minimum line”. Trade360’s account selection page, however, makes it clear that this minimum can vary based on a number of factors, such as deposit size.

Finally, some other account types are also available outside of this structure. These include an Islamic account, which is a common option offered by brokers as part of an attempt to ensure that those who follow the financial aspects of Sharia law can still trade. Traders who wish to use this sort of account are advised to get in touch with the broker in order to ascertain more information. And another option for traders to consider is a professional account. This account offers traders a higher amount of leverage compared to a standard personal account, as the options outlined above all are. This distinction comes about as a result of regulations from ESMA, or European Securities and Markets Authority – which attempts to regulate the sector and offer individual retail traders some protection.

In short: while this system of account selection may seem complicated, it in fact offers traders an almost unrivalled level of choice compared to the situation across the rest of the trading industry. It provides traders with the chance to select the kind of account that works best for them, and to essentially pick and choose the features they need.

Platforms

Trade360 is somewhat unusual in that it does not offer the same platforms to every user. Instead, traders will receive a choice of account types based on what sort of account they choose to set up with the broker. As outlined above, if they opt for a mini account they will only receive access to MetaTrader 4. But if they go for any of the other account structures available, they will be able to access MetaTrader 5.

MetaTrader 5 comes with a whole host of excellent, high-end features. These include just over 80 technical indicators and charting tools, for example, while there are also just over 20 timeframes to choose from for when it comes to assessing price chart change over time. MetaTrader 5 also contains an option to build bespoke indicators all of your own thanks to the power of the MQL-5 developer environment. Those traders who are on MetaTrader 4 might find themselves slightly more restricted in terms of functionality.

Away from web or computer-based trading, meanwhile, it’s also possible to use Trade360’s innovative mobile platform for trading purposes. This is available as an app either from the Google Play Store or the Apple Store, and allows for round the clock trading as well as various support options including live chat and position simulation.

Support

Trade360 offers a range of help and support options for traders who wish to find out more information or simply get some advice on how to get started. The help centre on the broker’s website provides a segmented list of frequently asked questions, including some on the topic of finance, admin or technical issues.

If the trader’s question or issue is not resolved by this option, they can also begin a process of contacting the broker directly. There is a “Contact us” link on the “Help Centre” page, although at the time of writing this link did not appear to be functioning.

Aside from direct, personal assistance on matters relating to trading or accounts, Trade360 also provides an education service which is designed to help traders ensure they get the information they need in order to make informed trading decisions. In the “Education” section of its website, Trade360 provides traders with a range of informative sections to choose from – including an explainer on what each of the asset classes it offers actually is, plus a handy overview of CFD trading for those who want to get their head around this complex topic before beginning.

Trading Instruments

A range of trading instruments are available at Trade360, and traders can select the ones which are right for them in order to put their portfolio together.

Don’t forget that Trade360 is a contracts for difference, or CFD, broker. This means that the assets on offer with this broker are not the actual underlying assets, but are instead what are known in the finance world as “derivatives”. The trader therefore trades on the value of the underlying market trends, which can both rise and fall, rather than actually acquire the asset. So: a trader trading foreign exchange pairs at Trade360 will not actually buy up or have to hold any currency, but will still be able to benefit from any price movements in that particular market. The whole system is powered by what is known as “leverage”, which means that traders can in essence increase the size of their stake by taking some form of credit from Trade360 – and while this could mean that any successful investments have a larger pay-off, it could also mean that any failed investments result in a bigger loss.

As is to be expected at a major broker, one of the main asset classes on offer is the foreign exchange currency pair. There may be some slight disappointment in store for traders at this broker when it comes to foreign exchange pairs, though. The variety of pairs available for trade is broad, but those looking to trade something specific outside of the major or minor foreign exchange pairs could be disappointed.

Spreads for foreign exchange pairs are also often quite competitive. At the time of writing, the British pound/Australian dollar pair could be traded with a spread of just 0.22%, although this is subject to change – so it is advisable for traders to check out the currency trading pages of the broker’s website before pressing ahead. The spread refers to the difference between the “buy” price of an asset and the “sell” price, a proportion of which is usually charged in order for the broker to earn money.

Moving away from foreign exchange pairs, the next class of asset to consider is the commodity. Again, a range of commodities are available to trade – although the options highlighted on the broker’s category page are somewhat limited. Oil and natural gas can both be traded, as can precious metals such as silver and gold.

The indices category has a modest collection of big global names on it, including the Japanese Nikkei and the US Dow Jones. Also featured is the S&P (or Standard and Poor’s) 500, plus the Australian Securities Exchange and – in a niche move – the WIG20, the Polish Warsaw Stock Exchange index.

Exchange traded funds, or ETFs for short, are often popular because they can offer some cost-effectiveness and ease of use for traders – at least compared to other major asset classes. They bring together a range of different asset types under one roof, and allow traders to mix together asset classes as diverse as bonds and commodities. These are available at Trade360, and there is a double-figure sum of ETFs on offer.

The last asset class to be considered is stocks. This is one of Trade360’s real strong points, and there are more than 450 options to choose from, and some of the most recognisable household names on the market – such as Apple, Facebook and Netflix – are all represented. Leverage rates can, however, vary. Some stock options have leverage rates beginning at 1:5, while others go as high as 1:20.

In sum, Trade360’s range of asset classes is considerable – but there are competitors on the market who may be able to offer a more specialist of choice for those traders who want something highly specific. If this applies to you, it could be worth exploring some other brokers instead.

Deposits/Withdrawals

The deposit process at Trade360 is fairly easy, and is unlikely to pose problems for most traders. First of all, there is a wide variety of funding methods on the table for traders to pick from. Several major card options can be used, and both credit and debit cards are accepted. Those who would like a bit of extra anonymity or flexibility can also opt to use a pre-paid card. Aside from cards, traders can also select the e-wallet option. Skrill and NETELLER are both accepted at this broker.

A bank transfer option is also available. Those making bank transfers can either make their transaction online or do it locally, in-person.

In terms of fees, the good news for traders is that there are no fees levied on any deposit.

In terms of withdrawals, meanwhile, there is a turnaround time of three business days when making your withdrawal request. The exact timeframe involved here could vary based on the exact withdrawal method you go for.

It’s important to note here that withdrawals are not permitted until the trader has been through the document certification process. The “know your customer” rules insisted upon by regulators mean that this must take place.

In the event that a withdrawal does not go to plan for some reason, a trader is advised to get in touch with the broker directly.

Conclusion

Overall, Trade360 is a decent broker offering traders a wide range of options for traders to go for. Asset class options are broad enough, although those traders who are searching for trading instruments that are a little more niche may find themselves struggling. The “CrowdFeed” aspect of this broker’s platform is one particularly distinctive benefit, though, and is something that many traders will no doubt benefit from. The same goes for the wide range of account types available to be chosen, too: this array of options means that traders can get an account structure that works for them, with trading conditions that suit their needs.

And with a fairly flexible and prompt deposit and withdrawal process, the financial management side of things appears to be good at this broker. Traders should, of course, always exercise caution when it comes to signing up for any broker website, and do their own research. But Trade360’s apparent legitimacy and regulation with many major regulators means that it is a good enough broker as any to consider.